Taiwan's semiconductor equipment imports up 80% over last 5 years

With local IC suppliers keen to expand production and upgrade technologies, imports of semiconductor equipment to Taiwan surged almost 80 percent over the past five years, according to the Ministry of Finance (MOF).

With local IC suppliers keen to expand production and upgrade technologies, imports of semiconductor equipment to Taiwan surged almost 80 percent over the past five years, according to the Ministry of Finance (MOF).

Data compiled by the MOF’s statistics department showed Taiwan’s purchases of semiconductor equipment totaled US$25.4 billion in 2021, up 79.9 percent from 2016, as Taiwanese firms spent more on capital expenditure.

In 2021, Europe served as the largest supplier to Taiwan by selling US$9.5 billion worth of semiconductor production machinery, surging 190 percent from 2016.

By country, the Netherlands was the top exporter, according to the MOF.

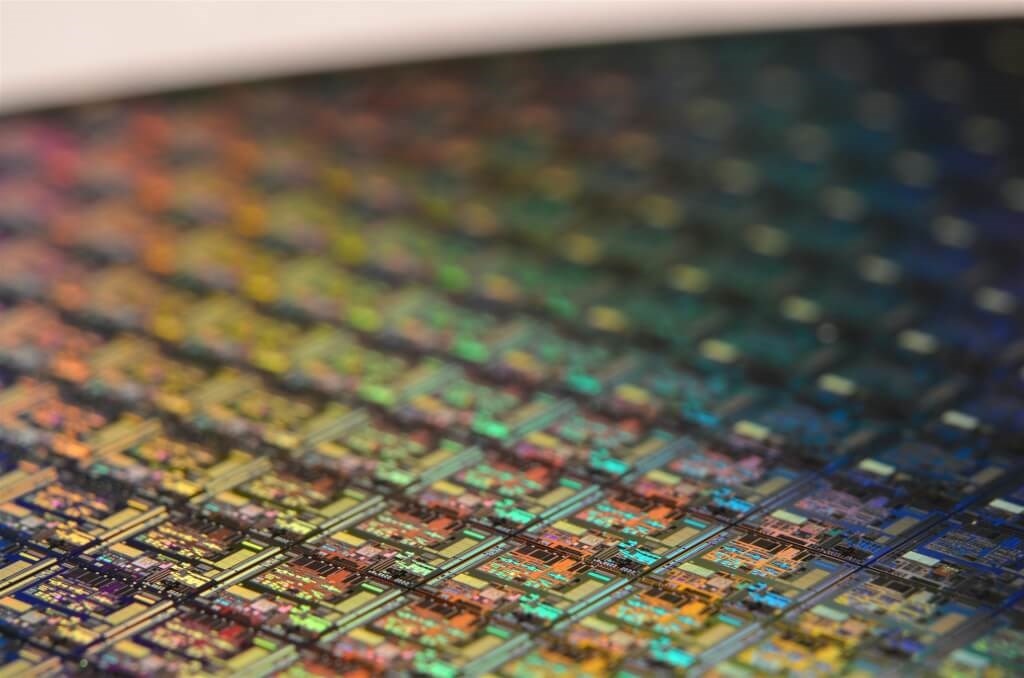

Market analysts said the Dutch photolithography systems maker ASML Holding N.V. has become one of the most important wafer foundry equipment suppliers to Taiwanese manufacturers.

One of those supplied by ASML is Taiwan Semiconductor Manufacturing Co. (TSMC), the world’s largest contract chipmaker.

TSMC has invested a significant amount in recent years to develop advanced processes, such as the firm’s 3-nanometer technology, which is scheduled to start mass production later this year.

According to the MOF, Japan was the second largest semiconductor equipment supplier to Taiwan with sales totaling US$6 billion in 2021, up 25.5 percent from 2016.

In 2021, Taiwan imported US$5 billion worth of semiconductor equipment from the United States, up 43.8 percent from 2016, while imports from the Association of Southeast Asian Nations bloc rose 57.0 percent in the five years to hit US$3 billion in 2021, the MOF said.

The MOF said Taiwan bought US$20.3 billion worth of semiconductors from China and Hong Kong in 2021, up 190 percent from 2016, with demand for memory chips, including dynamic random memory access (DRAM) chips, on the rise.

Meanwhile, the MOF said Taiwan sold US$155.5 billion worth of semiconductors overseas in 2021, up almost 100 percent from 2016.

According to the MOF, demand rose sharply on the back of the presence of emerging technologies such as 5G applications and high-performance computing devices.

In addition, Taiwan’s exports of computers and accessories and computer components totaled US$17.6 billion and US$12.0 billion, respectively, in 2021, up 250 percent and 190 percent from 2016.

Rising trade tensions between the U.S. and China have prompted many Taiwanese investors to return home to expand production, the MOF said, adding the stay-at-home economy amid COVID-19 also boosted sales.

The MOF said Taiwan’s semiconductor exports totaled US$45.7 billion in the first quarter of this year and grew further to US$47.13 billion in the second quarter before falling to US$46.85 billion in the third quarter due to weakening global demand.

However, the MOF said annual semiconductor exports for 2022 were set to exceed 2021 to hit another new high.

Date: 2022-10-29

Source: Focus Taiwan